Every passenger entering or leaving the Indian borders has to pass through Customs check.

Customs Check and Clearance at Airports in India

Every passenger entering or leaving the Indian borders has to pass through Customs check. The individual must fill up the Disembarkation Card in which the quantity and value of goods that he has brought are clearly mentioned. On the arrival, the passenger is first cleared by an Immigration Officer who retains the Immigration portion of the Disembarkation Card. Thereafter the passenger takes the delivery of his baggage from conveyer belts & passes through Customs. Like all other International Airports, the passenger has the option of seeking clearance through a Green Channel or through a Red Channel subject to the nature of goods being carried.

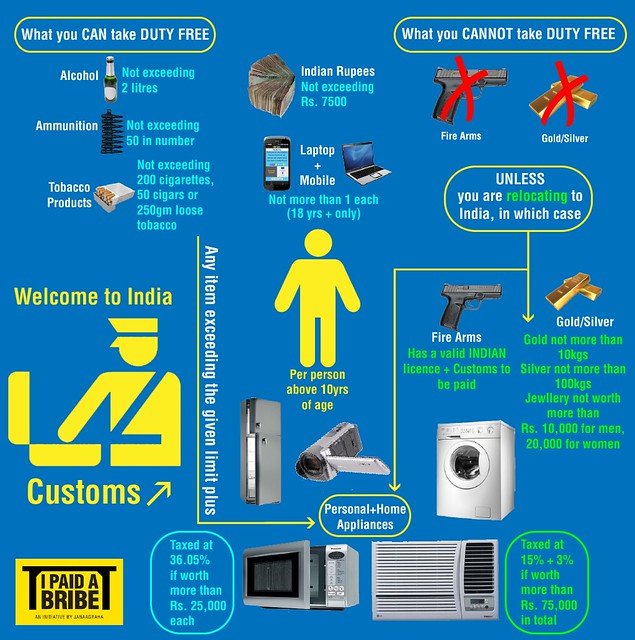

For the purpose of Customs clearance of arriving passengers, a two-channel system has been adopted:

(i) A Green Channel for passengers not having any dutiable goods.

(ii) A Red Channel for passengers having dutiable goods.

How much foreign exchange can one buy when traveling abroad on private visits to a country outside India?

For private visits abroad, other than to Nepal and Bhutan, viz., for tourism purposes, etc., any resident can obtain foreign exchange up to an aggregate amount of USD 10,000, from an Authorised Dealer, in any one financial year, on self-declaration basis, irrespective of the number of visits undertaken during the year. This limit of USD 10,000 or its equivalent per financial year for private visits can also be availed of by a person who is availing of foreign exchange for travel abroad for any purposes, such as, for employment or immigration or studies.

Some common Dutiable Goods

1. Fire arms.

2. Cartridges of fire arms exceeding 50.

3. Cigarettes exceeding 200 or cigars exceeding 50 or tobacco exceeding 250 gms.

4. Alcoholic liquor or wines in excess of 2 litres.

5. Gold or silver, in any form, other than ornaments.

6. One laptop computer (notebook computer) over and above the said free allowances is also allowed duty free if imported by any passenger of the age of 18 years and above

7. The goods over and above the free allowances shall be chargeable to customs duty @ 35% + an education cess of 3%

8. Alcoholic drinks and tobacco products imported in excess of free allowance are chargeable to custom duty at the rates applicable to their commercial imports as per the Customs Tariff Act.

9. Import of Indian currency is prohibited. However, in the case of passengers normally residing in India who are returning from a visit abroad, Indian currency up to Rs. 7500 is allowed.

10. In case the value of one item exceeds the duty-free allowance, the duty shall be calculated only on the excess of such amount